Do you want help? Do it!

Part one.

Introduction to the series

A friend of mine was a successful entrepreneur in the advertising business for decades. He often reminisced about his internship in Switzerland with a renowned agency run by an experienced marketer with the best reputation. Like many managers and bosses, he did not shy away from the constant "ideas" of his people who came to him with suggestions on what would be good to do, what to improve, what groundbreaking inventions they had come up with. He is said to have always listened attentively and patiently to all of them and praised them when they were finished. He patted them on the shoulder and said: "Great idea! Do it!"

I also had subordinates, and it took me a long time to understand that they weren't coming to tell me their great ideas, they were coming with what to do. That they were actually "tasking" me. They felt that by telling me their great ideas, that was the end of it for them, the rest was my job.

Like the advice of "insiders" when they advise how to deal with inflation, "You need to buy stocks, they're down now!" or "It is wise to invest in mutual funds, they are managed by experts who know how to deal with inflation" or " Buy bonds,... invest in commodities...".

However, I almost never read along with this advice whether the "advisor" has tried buying stocks, bonds or investing in funds himself.

So I decided, taught by the example of the head of an agency in Switzerland, that if I had something like "a great idea" , then it was time to "do it", to make it happen.

So inflation and the advice to save, because these bad times are going to get worse...

I'm scared to invest in stocks because I see companies shaking in their foundations. I'm not sure that only those who manage depositors' money will get rich in mutual funds, while the depositors themselves will come up short and their savings will shrink instead of grow.

I have chosen my own path. Not that I understand it perfectly, and I certainly do not intend to speculate, I just tell myself that I will manage it myself, at my own risk, so that I do not end up losing the savings I want to protect altogether.

In all of this, I realize that I'm not exactly the thrifty type. I have decided to save gradually, just a little at a time, once a month. Not paper money, but gold money, literally!

Old wisdom says, "The times they are a-changin', gold is sure!"

We'll see. I have chosen one commodity, if you can even call it a commodity, and one company to focus on. I've decided on gold coins from the Czech Mint. The company has a good international reputation, they mint coins for the Czech state, their certificates are valid everywhere in the world, they speak a language I understand, and again, I'm not going to take any unnecessary risks. But I will no longer be indifferent to the fact that inflation reduces the value of my hard-earned money.

How to start?

I don't have savings that I'm worried about what will happen to them now, so I don't have to think about whether I'm investing ten thousand or fifty thousand euros in gold coins. That doesn't bother me (perhaps I should add that unfortunately...).

But every month I take, say, give or take a hundred and save it - in a gold coin.

Despite my aversion to the advice of know-it-alls, however, I decided to take my own advice, and so I had a chat at the Czech Mint. I guess they weren't impressed when I said I wanted to invest about 100 euros in gold coins, but that was all I wanted to risk in a game against an opponent from Team Inflation.

Surprisingly, for a hundred euros, there is a large variety of precious metal coins to choose from. I was pleased with that.

I narrowed it down to two coins fairly quickly. One is a coin from the Slovak investment coin issue, the Slovak Eagle, and the other is the Czech Tolar.

Both have a weight of 1/25 oz, one twenty-fifth of an ounce, so nothing that would break my pocket. The Eagle investment coin is a 2021 issue, unnumbered, only 4,000 were minted. The Eagle seems to have already found a following among investors, and looking at the website www.ceskamincovna.sk, it appears to be true that some Eagle coins are already sold out.

The golden tolar, or tolar as we call it, is one of the commemorative coins of the Czech Mint. I have two choices - either I opt for the unnumbered issue of the gold toliar for 108 Euros, of which 9,500 were minted, or the numbered issue of the toliar for 133 Euros. Only 500 pieces were minted, so it's basically a limited edition and therefore obviously more expensive.

As I say (write), I'm no expert, but I like the idea of having something from a limited edition, just pure snobbery...

Besides, I like the story of the Czech Tolar.

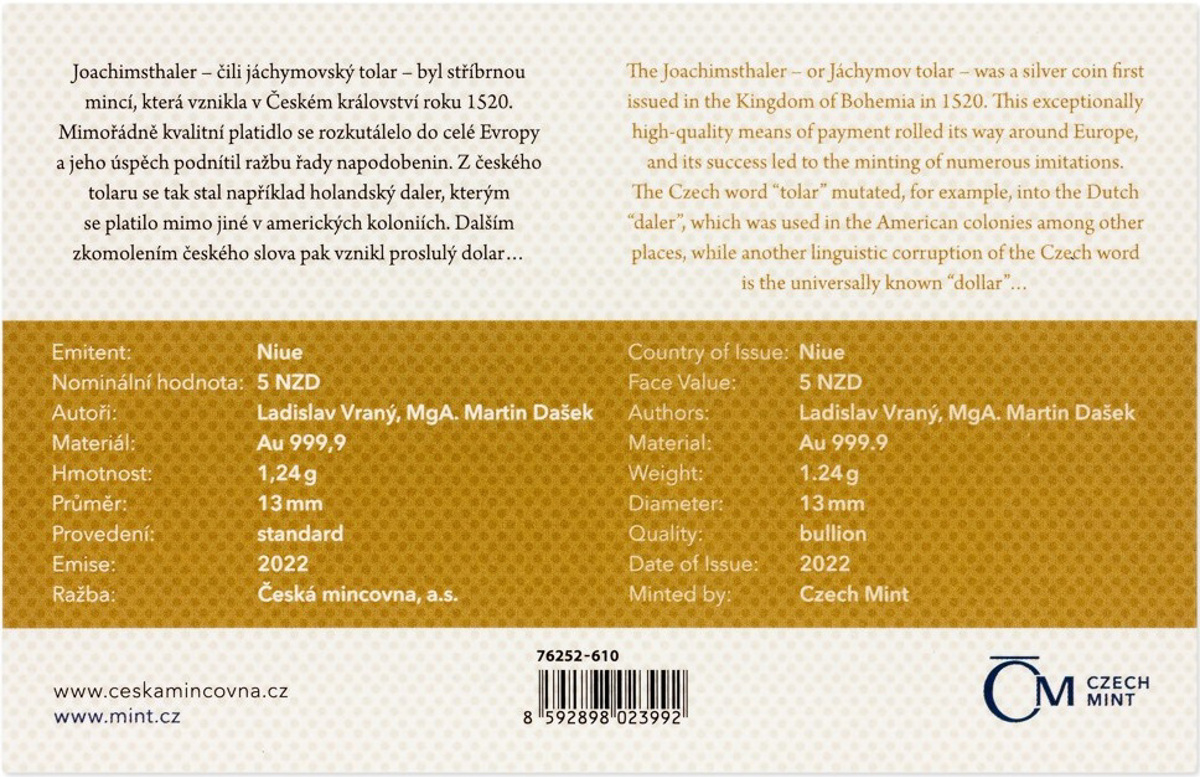

Actually, I only recently learned that it was the Czech Tolar that all the dollars in the world are named after today. The Czech Mint website says so:

"The Czechs gave the world its most famous and respected currency. Which one is it? Dollar! Somewhere in Texas, no one probably knows that the roots of their famous currency go back to a mining town in a small country in the heart of Europe. That's why it's worth remembering a forgotten Czech heritage that began five hundred years ago... The Jáchymov tolar was a silver coin that originated in the Czech Kingdom in 1520.

The extremely high quality coin spread throughout Europe and its success prompted the minting of many imitations. The Bohemian tolar became, for example, the Dutch daler, which was used for payment in the American colonies, among other places. Another corruption of the Czech word was the dollar."

That's a story I like, because I like stories.

Plus, this is an issue that was only released in October 2022, so it's a very "fresh coin". It might be all the more interesting to see how its market price changes among collectors and investors. And whether it can protect me at least a little from inflation, which has already reached almost 15%. In other words, if I had invested my hundred a year ago in a gold coin, it might still be worth at least that hundred today, whereas today it is worth only EUR 85.

So I choose a 1/25 oz gold coin with numbered thalers for 133 Euros.

So my own battle with inflation begins ! Like this series of blogs. I plan to swap plus or minus one paper hundred each month for a "golden hundred" and see what happens. If I've done well, I'll be happy to share in this blog series. If I haven't had a completely lucky hand, I'll write about that too. We'll see in a month's time. I'll let you know if I've been successful against inflation. Until then, goodbye!

čeština

čeština

slovenčina

slovenčina

english

english